Historic and early indicators suggest the cosmetic and beauty industry will do relatively well and use innovation opportunities to its advantage. Digital will play a critical role in saving the beauty industry.

Early predictions and consumer responses

Lockdown’s effects on the cosmetics and beauty industry will show up clearly in economies around the world. This global industry generates $500 billion in sales a year and accounts for millions of jobs, directly and indirectly. It’s ability to bounce back or potentially reinvent itself will determine the extent of the damage. Historic and early indicators suggest the industry will do relatively well and use innovation opportunities to its advantage.

Cosmetics Design drew up a summary of multiple research firms’ findings about the state and possible future of the beauty industry in the Americas in April 2020. The industry as a whole proved to be “fairly recession proof,” according to Kline and Company’s Carrie Mellage. She expects the industry to fully recover within about three years, as was the case after previous recessions. Her optimism is due to the industry’s significant and fairly seamless shift to online sales.

The impact and recovery are dependent on a product’s market position within the broader industry, however, ranging from need-to-have products through to nice-to-have items. Products related to sanitation and hygiene are experiencing higher-than-usual sales while basics like shampoos and deodorants are generally selling as usual. Soothing solutions like facial and nail products will see initial declines but will likely stabilize over time, while ‘can-wait’ categories, including fragrances and color cosmetics, are expected to take a few years to recover from this recession.

Impact over time – adapting to a new economy

Despite the industry ‘as a whole’ doing ‘relatively’ well, however, many individual businesses are feeling the heat. Beauty-service workers have understandably faced the biggest obstacles – both legally and practically – not being able to meet customers face-to-face for most of this year, while safety measures like masks complicate interactions with clients.

Many beauty workers have shifted their focus to activities like online make-up tutorials during this time, reports Poshly and Mintel. The downside to this is that consumers might become less reliant on beauty professionals, experimenting with and learning new beauty techniques at home.

Not only did business slow down for retailers and beauticians, cosmetic manufacturers around the globe had to shut down their production units as a result of the labor shortage. As is the case in various other industries, the cosmetics and beauty industry also recognizes the need to rely on multiple global manufacturing locations, and even localise where its feasible. The pandemic has reminded everyone how easily an unforeseen disaster can put a whole industry on hold if it becomes too reliant on a few players.

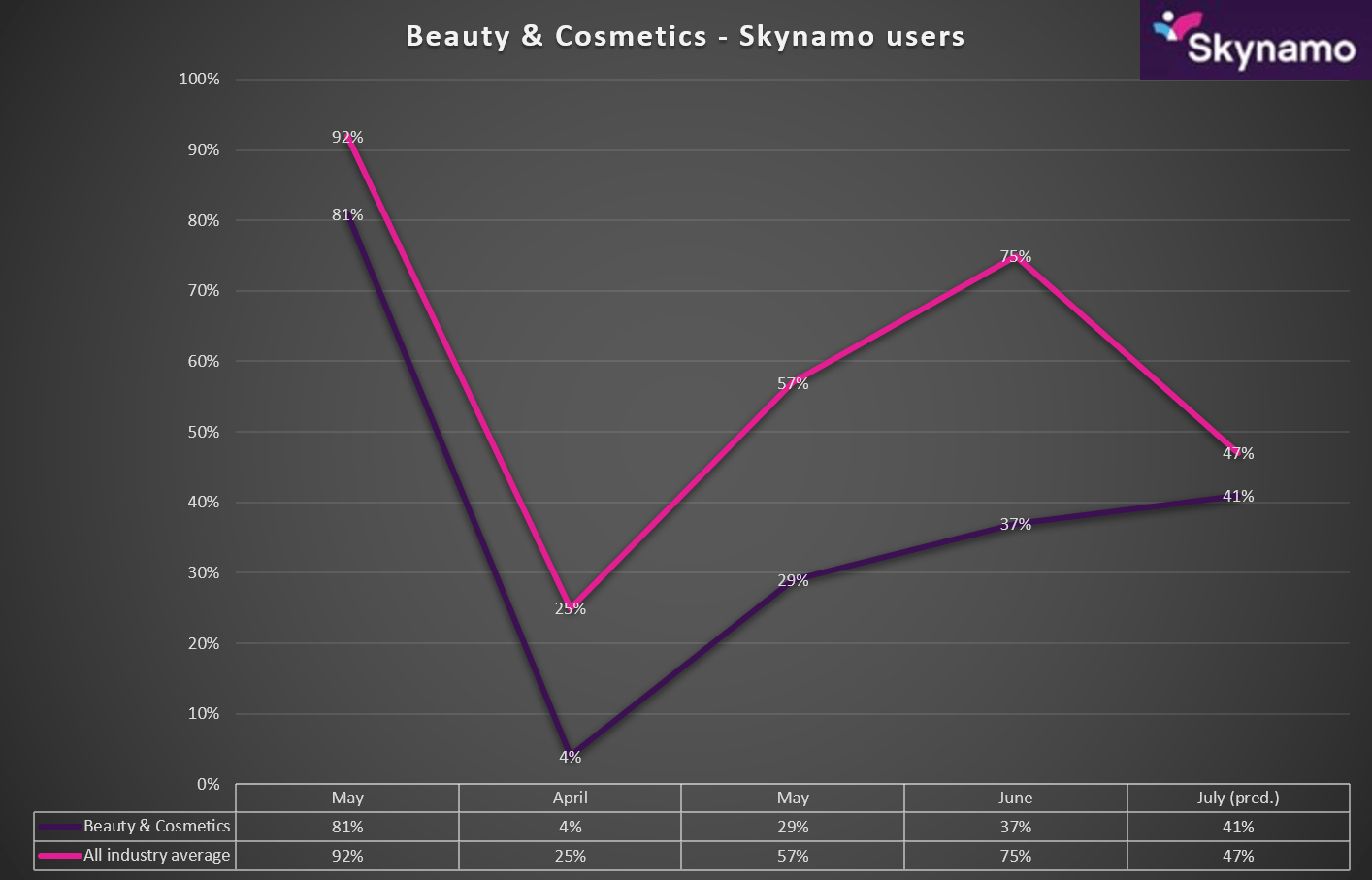

Skynamo beauty & cosmetics industry user data indicates a slow-but-steady recovery trend, similar to the current global industry trend:

As is the case in most industries, digitization is the most significant and most consistent change across the board. In most major beauty-industry markets, in-store shopping accounted for up to 85% of purchases prior to the COVID-19 crisis according to a recent McKinsey report. Approximately 30% of this market shut down at one stage due to te closure of premium beauty-product outlets because of COVID-19, reports McKinsey. Some of these stores will never open again, while new openings will likely be delayed for at least a year. Retailers forced to close stores went digital, not only to sell their products online but also added product tutorials to their offering.

Beauty goes digital

Digitization continues to rise, and many brands may choose to lean more on this channel, even after restrictions lift and consumers move around more freely again. The shift to digital, which has been happening gradually, has been accelerated by the crisis. Should more consumers adopt online shopping in the long run, it makes sense to keep digital structures in place and remain prepared for similar future recessions. Beauty and cosmetics giant, L’Oréal reported a 52.6% growth in e-commerce sales during the first quarter of 2020, with online sales making up nearly 20% of the groups total sales. This figure may well be higher for the second quarter during which much of world were under strict lockdowns for the extent of the period.

McKinsey highlights the need for all beauty-industry players to prioritize digital channels to engage with both existing and prospective customers. Recognizing the disruptions that safety and hygiene concerns may cause through the whole distribution channel, their report also draws attention to the need to accelerate the use of artificial intelligence in and customization of operations processes.

Skynamo agrees that while a significant amount of cosmetic and beauty industry engagements will happen online, digitization plays a crucial role in face-to-face interactions that the industry still depend on. Our all-in-one field sales platform helps distributors of beauty products to visit and sell to customers in a way that is productive, safe and completely digital. Outside salespeople who visit beauty stores can do consultations and take orders with complete access to relevant business information on their mobile device. Customizable features include a safety screening form that managers can set up for their teams to keep selling safe and productive.